Table of Content

Copy of identity card issued by the current employer / proof of income in case of self employed professionals / businessmen. The cheque for the loan amount is drawn in favour of the builder or seller as the case may be. In the case of an under-construction property, ICICI Bank disburses loan amounts appropriate to the state of construction.

However, to make things easier, it is advised to do thorough research, compare interest rates, and understand all the processes before you start with your applications. The home loan interest rate for NRIs varies with the financial institution from which it is taken. Interest rates for NRIs are generally higher than those for Indian residents due to the higher risk factor.

Tax Benefits of NRI Home Loans

For a smooth transaction and a hassle-free ownership experience, make sure you check and verify all the essential papers. Payments are often made through NRO, NRE, NRNR, and FCNR accounts. These permitted accounts could alter in accordance with RBI rules. On the other hand, if the home is on rent, one can claim the complete interest payable component as a tax deduction on their home loan.

Yes, NRIs can also get home loans in India if they meet the eligibility requirements. The rate of interest on the loan shall conform to the directives issued, if any, by the RBI and/ or NHB. If you are self-employed, you should have been abroad for a minimum period of 3 years. We'll ensure you're the very first to know the moment rates change. Details of other ongoing loans, if any, along with the loan sanction letter.

HDFC Ltd Home Loan Pollachi | Interest Rates 2022 | Branch Address

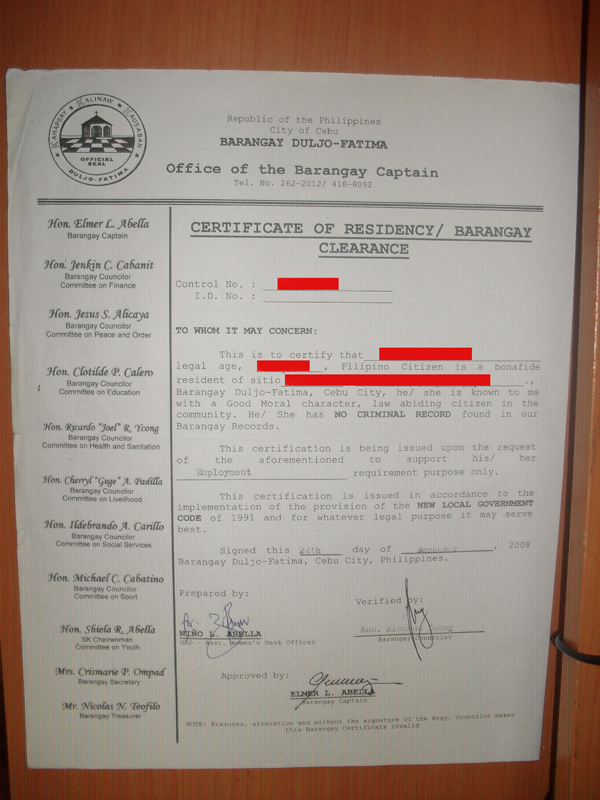

If the applicant is not in the country while putting up the applications, financial institutions may ask for a Notarised / attested copy of KYC from the Indian Embassy or consulate. PAN Card – All NRIs or PIOs have to provide a copy of the PAN Card for applying for the loan. It is a mandatory requirement for all co-borrowers. One can attain the status of being an NRI by staying overseas for more than 182 days.

HDFC Bank offers eligible Non-Resident Indian borrowers affordable housing loans at attractive interest rates starting at 6.75% p.a. With flexible repayment options on extended tenures up to 20 years. The processing fee ranges from Rs.3,000 to Rs.4,000 or up to 1.25% of loan amount.

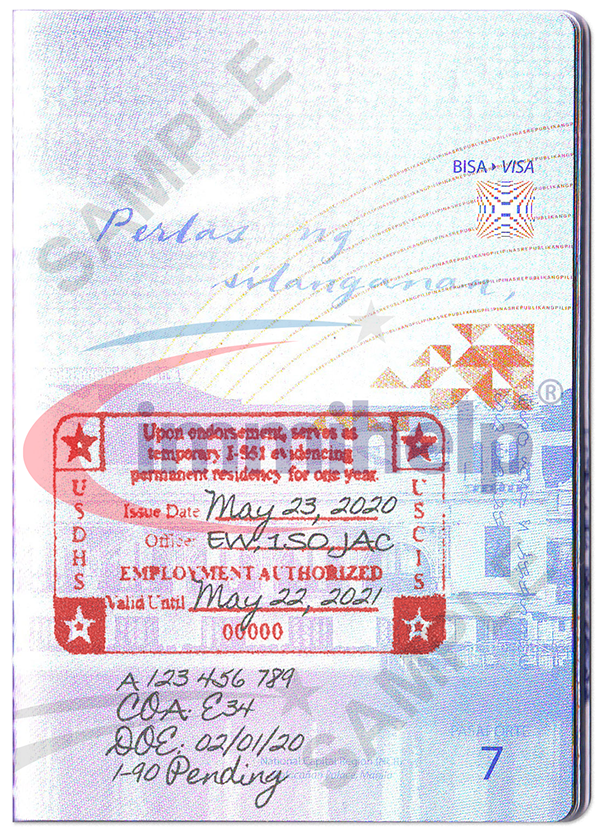

Document checklist for NRIs buying property in India

Are you considering buying a new home in India with a mortgage? Our application process is seamless and entirely online. You can even use our home loan EMI and eligibility calculators to plan better! Many NRIs buy property in India for various reasons - as a long-term investment; as a place to stay during their visits home; as a way to remain emotionally connected to India or for their families back home. Once you embark on the process, you will realize that buying real estate in India requires you to complete a few formalities and documentation. Here’s a quick checklist of what you will need at every stage.

Existing Obligation details – Applicants should provide the details and statement of account for the existing obligations they have in India and overseas. Latest Payslips – All the borrowers should provide three months payslips for the loan evaluation. In the absence of payslips, the salary certificate from the employer can also be availed.

And the worst part is that they charged simple interest for that. One time, they calculated wrong EMI and sent to the bank for processing. It bounced because of lack of funds and several charges were levied. I am chasing bank for 3 months for their mistakes but I am not getting enough response. Overall, I feel that they hide a lot of facts and try to take as much money as possible from thecustomers.

SBI NRI Home Loans ✓ Get detailed Information ✓ Documents ✓ Interest Rates ✓ eligibility for State Bank of India NRI housing loans. State Bank of India offer several loan schemes to buy a car or home for your family back in India, or to tide over unforeseen financial needs. Loan Tenure – Loan can generally be availed for a tenure between 11 and 15 years. However, the maximum tenure for Home Loan and a loan for home renovation is 20 years, and further, the loan tenure must not exceed the remaining time between the earlier of 60 years age or the retirement age. Borrowers need to provide the documents in English. In case any document is written in the Local language of the country where the borrower is residing, he needs to provide a translated copy.

The down payment for the NRI home loan should be done from direct remittances from abroad through normal banking channels or from Non-Resident External or Non-Resident Ordinary account in India. There is no cap on the number of home loans you will be able to take, to buy properties in India. However, during a loan application, you are required to be transparent about any other existing loan.

In order to help home loan borrowers save on the Pre-EMI interest, HDFC Bank offers Tranche Based EMI option on home loans availed for under-construction properties. The option allows borrowers to decide the instalments to be made until the time of possession of the property. In case the customer wishes to pay more than the interest, the additional amount shall be directed towards the principal repayments. The Tranche Based EMI option allows you to clear your home loan debt sooner by starting your EMIs before the possession of the property. Dully filled home loan application form affixed with passport size photographs of the applicants/co-applicants with signed across. Some NRI applicants even before applying for a home loan tend to have a power of attorney made.

The maximum funding that will be disbursed is 90% of the construction estimate. The maximum loan repayment term is 20 years or till retirement, whichever is lower. Tax benefits are also available for both the principal and interest component of the home extension loan under the Income Tax Act, 1961.

For self-employed NRIs, the minimum qualification required is Senior Secondary Certificate or an equivalent degree. An attorney can be anyone from family or friends as per the willingness of the customer. Bank Account Statement – The borrower needs to provide the latest six months bank statement for the salary account held overseas.

Home Loans for Self-Employed NRIs

HDFC Provides loans to all NRI's, PIO's and OCI's. Please click here to go to English version of the same page. SBI Frequently asked questions , has listed questions and answers, all supposed to be commonly asked in context of Home Loans.

To attract a continuous flow of remittances, India has been supporting its offshore population, including Non-Resident Indians and Persons of Indian Origin , to make property purchases in India. We have a network that is unmatched in terms of reach. We have a network of + branches, sales teams and processing centers across the country to cater to the housing loan requirements of individual customers. Please locate us and contact us for your home loan requirements. Post-COVID, Lenders like HDFC Ltd. have introduced an online application process in which the documentation can be done digitally by NRIs. Income Tax Documents – Various countries have different tax documents.

No comments:

Post a Comment