Table of Content

Generally, Experian is the credit history provider in most of the countries, you can refer to the list of credit bureau agencies for further details. Applicants working in Singapore also have to provide an income tax certificate. Singaporeans are also required to provide CPF account transaction for the last six months. For the duration of the loan, the housing loan must be paid in full upfront through direct remittances from abroad, either through regular banking channels or from other financial accounts that the RBI may approve. NRIs can avail of tax benefits on home loans by filing the income tax return in India under Section 139 of the Income Tax Act, 1961. However, most banks offer loans for a tenure of up to 30 years.

NRIs who are filing ITR in India have to provide the latest two years income tax return. Enlisting few income tax documents as per the countries. Applicants working in the UK should possess form P60. They hide simple interest charges of prepayment.

Repayment Period

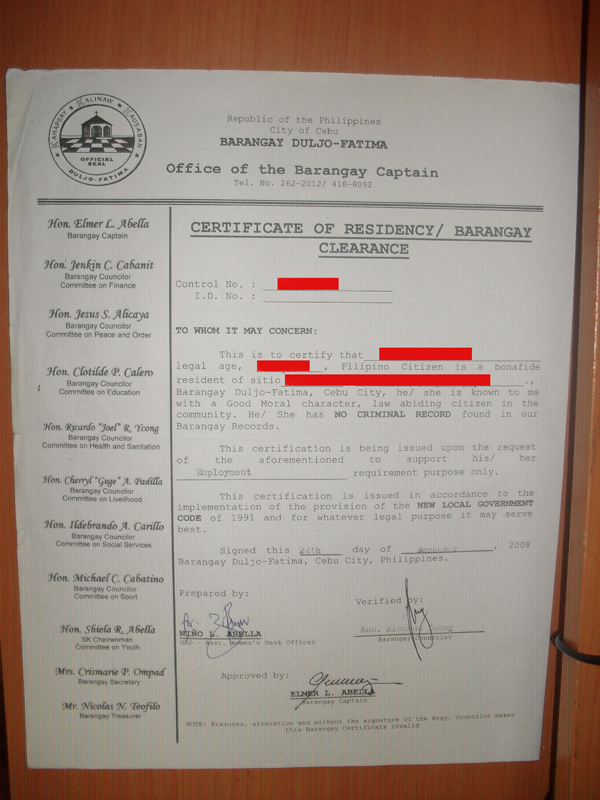

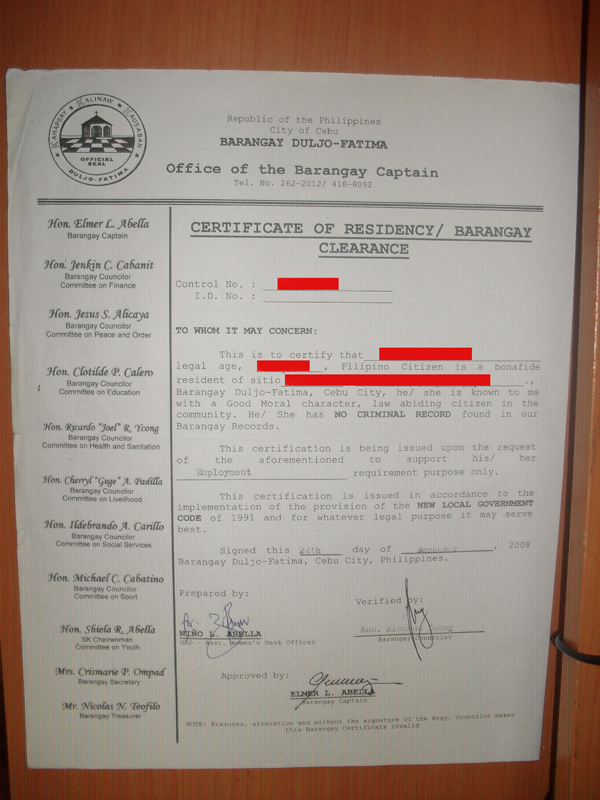

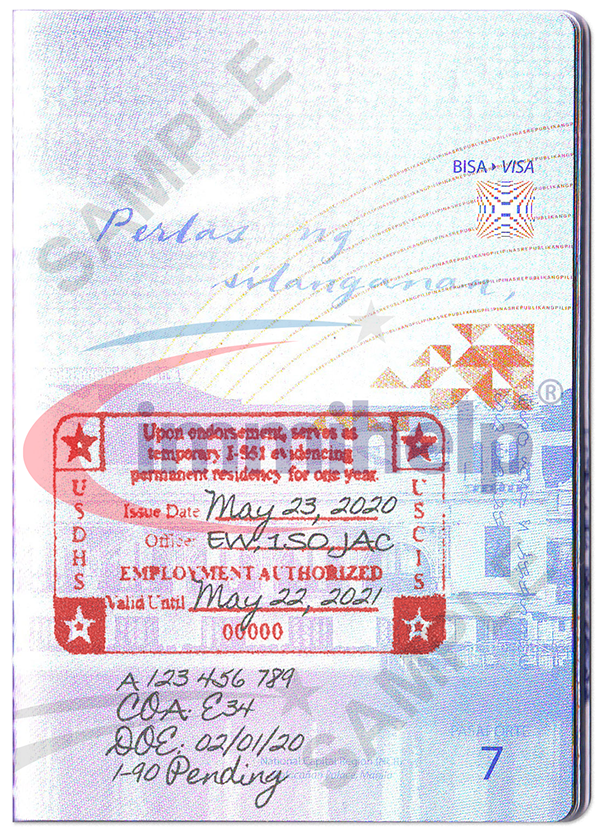

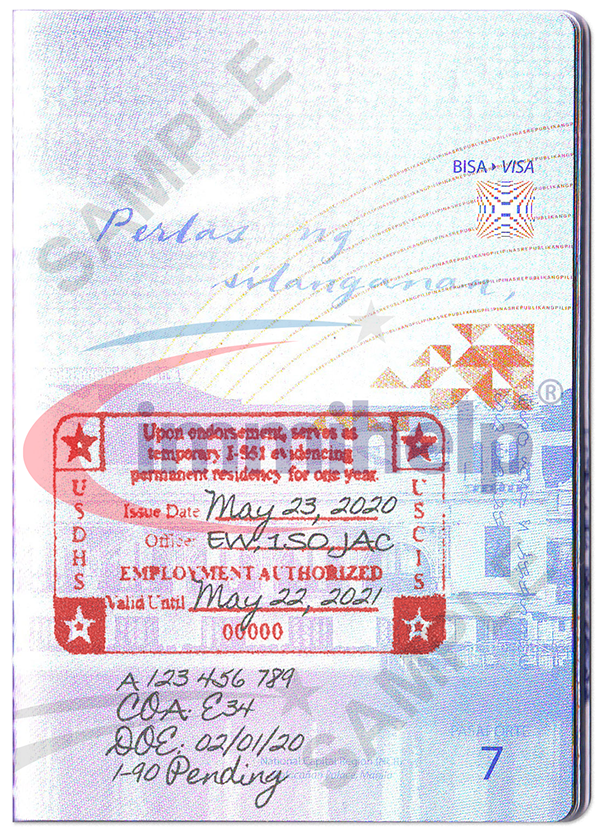

Copy of Visa – A valid Visa either stamped on a Passport or on paper needs to be provided to the financial institution. NRIs (Non-resident Indians) or PIOs are the key segments in the residential property consumers. Always use the customer care numbers displayed on Bank’s official website. Click below to download the list of documents mentioned above.

Please note these are basic documents required for Sanction. Additional documents may be required on case to case basis. Processing fee cheque from NRE/NRO/overseas salary account of the customer.

Loans for NRI - Key Benefits & Features

13) Cheque / Draft in INR towards the processing fee (as per applicable rates of the bank/NBFC). Note that most banks have a processing fee between 0.25% to 1.5% of the loan amount. Eligible borrowers can avail innovate housing loan schemes at attractive rates of interest. Notarized Power of Attorney, if applicant proposes to authorize a third party to execute the documents / complete the mortgage formalities / avail the loan installments.

Both salaried and self-employed individuals can apply for the loan. The maximum funding is up to 90% of the property value. The maximum repayment term is 20 years although this can be on the discretion of the bank based on the customer's profile.

CMS and Payment Solution

Co-applicant can be son, daughter, sister, brother, parent or spouse. We can include your spouse’s income to enhance your loan amount. Further, if there are any other co-owners, they too will need to be co-applicants. A co-applicant is not mandatory to avail a Home Loan. Personal Guarantor is required if there is no co-applicant. The co-applicant may be a resident Indian or an NRI.

Financially, it makes sense to purchase a property through home loan rather than through personal financing especially when you can invest your personal funds somewhere else for better returns. By clicking "Proceed" button, you will be redirected to the resources located on servers maintained and operated by third parties. SBI doesnt take any responsibility for the images, pictures, plan, layout, size, cost, materials shown in the site.

Also, some banks offer concession on the interest rate for women applicants. 4) Latest 6 months bank account statements of the salary account. Find below the NRI list of documents required for applying home loan. For some banks, the applicant should have a minimum overseas work experience of six months with a total work experience of 2 years.

For self-employed NRIs, the minimum qualification required is Senior Secondary Certificate or an equivalent degree. An attorney can be anyone from family or friends as per the willingness of the customer. Bank Account Statement – The borrower needs to provide the latest six months bank statement for the salary account held overseas.

The bank will reassess your repayment capacity based on your residential status and provide you with a revised schedule for repayments in case you relocate back to India. The revised interest rates will be based on the prevailing rates applicable to the residents in India depending on the type of loan you have availed. The new rates shall be applicable only on the outstanding principal amount after relocation. You would be issued a letter confirming the same. HDFC Plot Loans for NRIs can be availed by NRIs to purchase a plot through direct allotment or to purchase a resale plot in India.

HDFC Bank offers eligible Non-Resident Indian borrowers affordable housing loans at attractive interest rates starting at 6.75% p.a. With flexible repayment options on extended tenures up to 20 years. The processing fee ranges from Rs.3,000 to Rs.4,000 or up to 1.25% of loan amount.

The loan-to-value ratio for NRI customers varies from one bank to another, though the manner of calculation is the same in the case of a regular home loan. An English translation of the contract duly attested by employer / consulate / SBIs foreign branches / offices, or Embassy in case the contract is available in any other language. Concessions on charges for personal remittances and outstation cheques.

The lending institution also provides insights on prospective real estate projects, location, and offers to help make the right home buying decision suitable for you. HDFC Bank offers Home Loan Advisory Services in the country where the applicant is residing. This includes technical and legal counseling which shall help in making the right decision. Current account statement of the business entity for the last 12 months. Detailed Cost Estimate / Valuation Report from approved valuer in case of outright purchase of an existing house / flat. Proof of Identity – Copy of first four pages of passport and page with visa stamp, or IC / PIO card.

Offers

An NRI or PIO can also avail of a loan from an authorised dealer for acquiring a flat/house in India for his own residential use against the security of funds held in his NRE Fixed Deposit account or FCNR account. It is important that an NRI provides General Power of Attorney in favour of a local relative as per the draft of the bank which should be duly attested by the Indian consulate in the country of his residence. In case the loan borrower is in India, the POA can be locally notarized. Though the regular home loan tenures can be up to 25 years, loan tenure for NRIs is normally 15 to 20 years. Often this would be subject to the age of the borrower.

While a personal guarantor is required in case, there is no co-applicant, in case of a co-applicant the need for a guarantor is waived off. What is the maximum loan amount I am eligible for? The bank considers various aspects such as your monthly income, repayment capacity, credit score, creditworthiness, etc. before deciding on the maximum home loan amount you are eligible for. HDFC's Balance Transfer for home loans for NRIs can be availed to transfer an outstanding home loan amount from another financial institution to HDFC for lower interest rates.

No comments:

Post a Comment